Difference between Tax Invoice and Retail Invoice

Key Difference: The main difference between the two is that a tax invoice is generated when a company sells a product to distributor or a person who plans on reselling the product. Whereas a retail invoice, is generated when the sale is to an end user, i.e. someone who will use the product and not sell it.

It is expected that when one buys something, they will receive an invoice or a bill. An invoice is nothing but a bill that lists what item is sold, by whom, and for how much. It may include additional information, such as the date and time of sale, the address of the seller, etc. However, what one may not realize is that there is more than one type of invoice; one is a tax invoice, and the other a retail invoice.

It is expected that when one buys something, they will receive an invoice or a bill. An invoice is nothing but a bill that lists what item is sold, by whom, and for how much. It may include additional information, such as the date and time of sale, the address of the seller, etc. However, what one may not realize is that there is more than one type of invoice; one is a tax invoice, and the other a retail invoice.

The main difference between the two is that a tax invoice is generated when a company sells a product to distributor or a person who plans on reselling the product. Whereas a retail invoice, is generated when the sale is to an end user, i.e. someone who will use the product and not sell it.

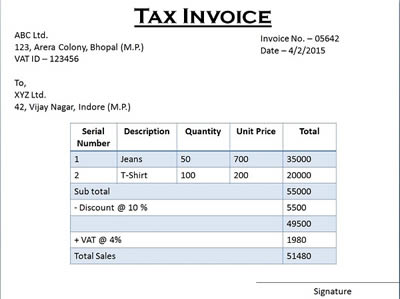

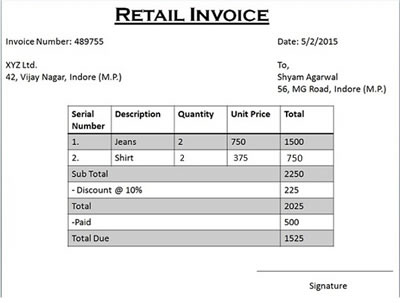

The purpose of a retail invoice is to be a proof of sale, i.e. show when a person bought what and from where and how much. Whereas the purpose of a tax invoice, is show the amount of tax that is paid on the product, in addition to all the other information. The buyer can then use this information as proof to claim tax credit on the tax that he has already paid.

In addition to the tax paid, the tax invoice should include the complete information about the buyer and the seller, as well as the information regarding the product, such as the description of the goods sold, the quantity, the rate per unit, and the total value of the goods sold. The same information can be included in a retail invoice, and it usually is, but is not required. The retail invoice can include the basics of the sale such as the seller’s information, the goods bought, and the price paid for them.

In addition to the tax paid, the tax invoice should include the complete information about the buyer and the seller, as well as the information regarding the product, such as the description of the goods sold, the quantity, the rate per unit, and the total value of the goods sold. The same information can be included in a retail invoice, and it usually is, but is not required. The retail invoice can include the basics of the sale such as the seller’s information, the goods bought, and the price paid for them.

Comparison between Tax Invoice and Retail Invoice:

|

|

Tax Invoice |

Retail Invoice |

|

Generated when |

A company sells a product to distributor or any person in the supply chain but not the end user |

When an end user of the product is purchasing then consumer receives the retail invoice. |

|

Product |

Product will be resold. It is for the middleman. |

Product will not be resold. It is for the end user. |

|

Tax |

Tax invoice is entitled to Input Tax Credit. The purchaser, on the strength of the tax invoice, can claim the benefit of input tax credit of the VAT paid on his purchases. |

Retail invoice is not entitled to Input Tax Credit as it is not going to be sold |

|

Content |

|

|

Add new comment