Tax Deduction

PAN Card vs AADHAR Card

|

PAN stands for Permanent Account Number. It is a number that is issued to any person who pays tax. Aadhar is an UID, i.e. a unique identification number. Its main purpose is to create a database of each... |

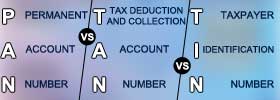

PAN vs TAN vs TIN

|

A PAN number is a number for anyone who pays income taxes or has financial transactions. TAN is required for any organization that deducts or collects tax at source. A TIN number is required by any dealer or... |

Income Tax Deduction vs Rebate vs Relief

|

Tax Relief is any program or incentive that helps reduce the tax in some way or another. This tax relief can be in the form of a tax deduction or a tax credit. A tax deduction is basically a deduction of tax.... |

Tax Exemption vs Tax Deduction vs Tax Rebate

|

A tax exemption exempts certain things, so that no tax must be paid on it. Tax deduction is an amount that is deducted from the total income of the person. Tax rebate, also known as tax refund, is a refund of... |

Tax Credit vs Tax Deduction

|

The tax credit is an amount that is deducted from the amount of tax that is to be paid by a person, whereas the tax deduction is an amount that is deducted from the total income of the person; as the total... |