Difference between Cross Check and Account Payee Check

Key Difference: A cross check is a check that cannot be directly paid to its bearer. It provides an instruction to the paying bank to pay the amount only through a banker. An account payee check is also paid only into the account of the person whose name is written on the check and thus, no counter payment is done. Thus, both refer to same kinds of checks.

Cross check and Account payee check, can often create confusion, especially for those who fear banking terms. However, they both refer to same type of checks which are only payable into the bank account.

A check or cheque refers to a document that authorizes and provides instructions to order a certain amount of payment from a bank account. The person who provides the authority is known as the drawer. The drawer has a current or checking account.

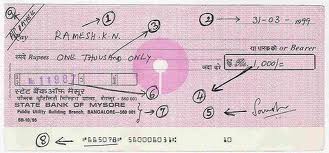

A cross check is a check with a mark comprising of two parallel lines. This mark provides additional instruction to the bank regarding the payment through the check. Two types of crossing are associated with these marks- general crossing and special crossing.

General crossing is obtained by making a mark on the check that is made by drawing two parallel lines across the top left-hand corner of the check. If the check is crossed and ‘or bearer’ is deleted, then it means that it cannot be just encashed at the counter by the bearer of check. If 'Account payee only' is added after canceling the bearer on check then the payment is only meant for only that person whose name is written on the check.

Special crossing is obtained by making a mark on the check by drawing two parallel lines across the check. It also mentions the name of the bank between the lines. These lines are also referred to as special or restrictive crossing. It refers to the condition stating that a bank will only make payment to the banker whose name is written in the crossing. These kinds of checks are considered more safe than a general crossed check.

An account payee check is not transferable and it is only paid into the account of the person whose name is written on the check. The words 'not negotiable' can also be used to generate the same effect. Thus, both refer to same types of checks.

Image Courtesy: bankingarticle.blogspot.in, crackbanking.com

Add new comment