Difference between Draft and Check

Key Difference: A check is a negotiable instrument which directs a bank to pay a certain amount from a specified account. A demand draft refers to a prepaid negotiable instrument which is used for transfer of money in a more effective manner. A demand draft may also refer to a tele-check or remotely check which is made by a merchant with the information of buyer’s checking account number. It does not require buyer’s signature.

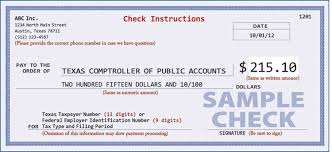

A check or cheque is a document that provides instructions to the bank in order to pay the money. A cheque or check drawer refers to the person who writes the check. A drawer possesses transaction back account with a bank in which he keeps his money. The bank is also known as the drawee, who is instructed to pay the person or company the money that is mentioned in the check. The details are added to the check like the name or institution of the payee. They are only paid to the payee (recipient of the money). However, in some countries like US, payee can endorse the check, which allows another party to receive the payment.

A check or cheque is a document that provides instructions to the bank in order to pay the money. A cheque or check drawer refers to the person who writes the check. A drawer possesses transaction back account with a bank in which he keeps his money. The bank is also known as the drawee, who is instructed to pay the person or company the money that is mentioned in the check. The details are added to the check like the name or institution of the payee. They are only paid to the payee (recipient of the money). However, in some countries like US, payee can endorse the check, which allows another party to receive the payment.

In India, a demand draft is basically a prepaid negotiable instrument, where the bank takes the responsibility for making the payment. It is drawn by one branch of a bank upon another for amount payable to order on demand. The person who requested the draft sends it to the payee who needs to present it at the drawee bank for payment. However, it is not compulsory that one needs to have an account in the bank for requesting a demand draft.

Demand drafts are more secured in comparison to cheque as they ensure that the sufficient balance in the account is present, Checks can be made payable through bearer or order. However, a demand draft cannot be paid to the bearer.

Demand drafts are more secured in comparison to cheque as they ensure that the sufficient balance in the account is present, Checks can be made payable through bearer or order. However, a demand draft cannot be paid to the bearer.

A check and demand draft therefore are very different from each other. Customer of the bank is the drawer for checks, whereas bank is the drawer for drafts. There are generally no charges for issuing a cheque book; however, drafts are only made by taking a small fee from the customers. A draft is more effect as it cannot be dishonored like cheques. Still, checks remain to be more popular than demand drafts due to the ease to usage.

A demand draft may also be used to refer to a remotely created check. It is created by the seller and mentions the buyer’s checking account number. Unlike normal checks, they do not require the signature. This is quiet dangerous as only the account number and routing number needs to be provided. Due to the frauds, the banks have been asked to increase their security measures.

Originally, they were developed for allowing telemarketers to sell products over the phone. In case, the user is not having a credit card, they could use this check. The information was transferred over the phone and the amount was deducted from the customer’s account and deposited into the account of the telemarketing company.

Comparison between Draft and Check (India):

|

|

Draft |

Check |

|

Issuing Authority |

Bank |

Individual |

|

Drawing Authority |

One branch of a bank or another branch of the same bank |

Account holder of a bank |

|

Can be dishonoured |

No |

Yes |

|

Facility for |

Everyone |

Only for current and saving account holders |

|

Bank charges |

A nominal fee |

Generally, not |

|

Parties involved |

Drawer, payee |

Drawer, drawee, payee |

|

Popularity |

Generally less |

Generally more |

Image Courtesy: window.state.tx.us, admissionjankari.com

Add new comment