Difference between Travellers Check and Personal Check

Key Difference: Travelers check are pre-paid pieces of paper that come printed with all the information that is required by the issuer.Personal checks are pieces of paper that are issued by banks that allow the money to be deducted directly from one account.

Before any vacation is planned, the biggest concern that a traveler or travellers comes across is currency. What form of currency should they carry? How much? Is it safe to carry that much cash? These all are normal questions that go through a person’s mind. There are many ways for a traveler to carry currency, of these travelers check and personal check are two forms.

Before any vacation is planned, the biggest concern that a traveler or travellers comes across is currency. What form of currency should they carry? How much? Is it safe to carry that much cash? These all are normal questions that go through a person’s mind. There are many ways for a traveler to carry currency, of these travelers check and personal check are two forms.

Travelers check are a dying breed, with many people declining to take them as a form of currency. However, before the 2000s travelers check is one of the most common forms of currency. Some, still swear by this today as it a safe and easy option. Personal checks are another option that are commonly used both locally and also abroad.

Travelers check are pre-paid pieces of paper that come printed with all the information that is required by the issuer. It can be issued in the home currency or the currency of the visiting country. It is often better to issue in the currency of the country that is being visited, as it removes the problem of having to constantly convert the currency. Also, the rate of conversation changes depending on where the check is given and the rate that the place is giving.

Travelers check are a safe option as it requires the issuer to sign twice – once when they purchase the check and again when they pay it to someone. Additionally travelers check come with many benefits such as if they are stolen or lost, they can be replaced at no cost and they don’t require an ATM or other computer based technologies.

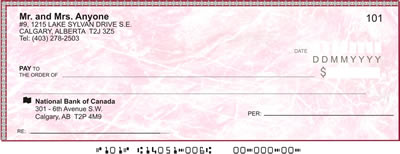

Personal checks are more commonly used in local places in order to pay large amounts or bills.These are often not used as travelling currency, but for some it works to pay for large things such as purchases and hotel bills, etc. Personal checks are the checks that are issued by banks that allow the money to be deducted directly from one account. The issuer would pay the check to someone and that person or institution will deposit it in their bank or give it to the issuing bank. If deposited, the money will be then deposited directly into their account.

Personal checks are more commonly used in local places in order to pay large amounts or bills.These are often not used as travelling currency, but for some it works to pay for large things such as purchases and hotel bills, etc. Personal checks are the checks that are issued by banks that allow the money to be deducted directly from one account. The issuer would pay the check to someone and that person or institution will deposit it in their bank or give it to the issuing bank. If deposited, the money will be then deposited directly into their account.

During travelling using checks becomes a little complicated as there are two ways to pay – one where the issuer to pay the person by writing the foreign amount on the check along with the alphabetical code. The person would then deposit the check into their account and the issuing bank would convert the amount before depositing the issuer’s account. Second, the issuer would have to write a self check with the amount they wish to withdraw and then ask the bank to convert it into local currency.

Travelers check offers far more protection and ease when it comes to traveling. However, personal checks are a great way to pay for large purchases.

Comparison between Travellers Check and Personal Check:

|

|

Travellers Check |

Personal Check |

|

Encashing |

Travellers Checks can be encashed at banks, travelling agencies or the place that issued the check. However, now many places have stopped encashing these checks |

Personal checks can be encashed only at banks. A person can give another person a check with their name on it but they would have to deposit it at the bank, which would then withdraw the money from the issuer’s bank |

|

Foreign Exchange Rate |

High exchange rate compared to currency |

Is on par with the rate of exchanging currency |

|

Safety |

Is a safer option compared to carrying currency as it requires the person’s signature to enchash it |

Is a safe option as it requires the issuer’s signature on the check |

|

Fees |

A 1% to 4% charge is levied as commission by the business accepting it. The bank where the check is issued may also charge a small fee to issue the checks. |

Only conversation rate is charged |

|

Replacement |

Free of charge replacement, if the issuer remembers the serial numbers of the checks that were stolen or lost |

If a checkbook or a check is lost, the issuer can call and ask to hold or cancel the check |

|

Advantage |

Free replacement if checks are lost or stolen A more secure way to carry currency as the check require signatures in order for the check to be cashed Not dependent on computer |

Check require the issuer’s signature in order for it to be cashed In case one loses the check, they can call the bank to cancel the check The person can issue the exact amount without having to play with denominations

|

|

Disadvantage |

A list of check numbers have to be noted including each check that is spent These days many places do not accept travelers check Horrible exchange rates |

Requires a bank to cash a check Not every place will take a check |

Image Courtesy:delcampe.net, chequesonline.ca

Add new comment