Difference between Swift Code and MICR Code

Key Difference: SWIFT code is a short for an even longer acronym known as SWIFT/BIC - Society for Worldwide Inter-bank Financial Telecommunication/ Bank Identifier Code. SWIFT code is a code that is assigned to an institution that acts as the institution’s identity in the foreign market. MICR code stands for Magnetic Ink Character Recognition code. This code has been devised for faster processing of checks.

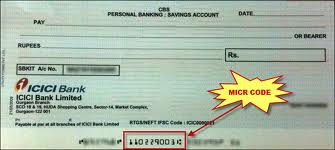

MICR and SWIFT both codes are usually used in context to financial system. IFSC code is indigenous to India, devised for inter-banks transactions within the country whereas MICR codes are used world wide. In India, MICR code can be easily found in a cheque leaf. One must get confuse between MICR and SWIFT codes an both are used as identification codes. Thus, let us explain them in brief to understand the differences between them.

SWIFT code is a short for an even longer acronym known as SWIFT/BIC - Society for Worldwide Inter-bank Financial Telecommunication/ Bank Identifier Code. This code was established in 1973 in Brussels as an identifier code. This code is assigned to both financial and non-financial institutions. When assigned to a business, it may also be known as a BEI or Business Entity Identifier. The purpose of this code is to allow easy transference of money between banks, specifically from one country to another. In addition to money, the banks also communicate with each other using this code and it can sometimes be found on bank statements.

SWIFT can also supply software and other services to banks and other financial institutions. The SWIFT code acts as the identity of the bank when it sends or receives a transaction. The code lets the other institutions know three main things the name of the bank, where the head office is located. For example the SWIFT code for the primary office of Deutsche Bank would be DEUTDEFF. The code is made up of:

SWIFT can also supply software and other services to banks and other financial institutions. The SWIFT code acts as the identity of the bank when it sends or receives a transaction. The code lets the other institutions know three main things the name of the bank, where the head office is located. For example the SWIFT code for the primary office of Deutsche Bank would be DEUTDEFF. The code is made up of:

DEUT – for Deutsche Bank

DE – for Germany, the country where the headquarters are located

FF – for Frankfurt, the city where the headquarters are located

The code is usually made up of 8-11 characters and is commonly made up such as the example given above: the name of the company and the city and country of the headquarters. This SWIFT code easily helps the institutions recognize each other. A person that is sending or receiving money from one country to another is commonly asked for the SWIFT code of the bank from which it is sending/receiving the money.

IFSC is a unique code and the code is of immense importance in carrying out the transactions in the banking sector. It is printed in the check books or can be easily found online by searching the code of the bank branch.

MICR stands for magnetic ink character recognition. MICR code is based on character recognition technology and helps in faster processing of checks. Like in India, every  bank branch has been provided by a unique MICR code, and thus RBI can easily identify the bank branch and the banking takes place at a faster rate. It is a nine digit number. The components of MICR are:-

bank branch has been provided by a unique MICR code, and thus RBI can easily identify the bank branch and the banking takes place at a faster rate. It is a nine digit number. The components of MICR are:-

1. The first three digits refer to the city code (location of bank branch)

2. The next three digits represent the code of bank.

3. The last three digits refer to the bank branch code.

MICR codes uses a special ink which is sensitive to magnetic fields and thus information can be encoded in the magnetic characters. This is used for enhancing the security in the transactions. For example, a counterfeit check can be detected easily, as the magnetic ink line will not respond to magnetic fields and thus will provide an incorrect code when scanned. This code also helps in avoiding the errors that can be generated in the case of manual clearing of the checks.

Thus, we can easily say that both are very different to each other. SWIFT basically defines the identity of an institution and in most of the cases it deals with the banking institutions. On the other hand, MICR code has been designed to speed up the process of checks clearance. The fraud cases can also be traced with the help of MICR codes. SWIFT codes contain characters, whereas MICR codes in India consists of digits that represent the identity of a bank. The SWIFT codes are not written with the special ink like in the case of MICR codes. SWIFT codes are related to international transfers, whereas MICR codes are basically for the usage of banks dealing with transfers within the country.

Image Courtesy: bankkhojo.com, fingyan.com

Add new comment