Tax Relief

PAN Card vs AADHAR Card

|

PAN stands for Permanent Account Number. It is a number that is issued to any person who pays tax. Aadhar is an UID, i.e. a unique identification number. Its main purpose is to create a database of each... |

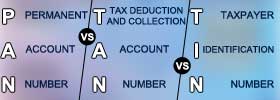

PAN vs TAN vs TIN

|

A PAN number is a number for anyone who pays income taxes or has financial transactions. TAN is required for any organization that deducts or collects tax at source. A TIN number is required by any dealer or... |

Income Tax Deduction vs Rebate vs Relief

|

Tax Relief is any program or incentive that helps reduce the tax in some way or another. This tax relief can be in the form of a tax deduction or a tax credit. A tax deduction is basically a deduction of tax.... |