Taxes

Form 16 vs Form 16A

|

The primary difference between the two is the fact that the TDS deducted on Salary is reflected in Form 16, whereas the TDS Deducted on Other Payments is reflected in Form 16A. Additionally, Form 16 is... |

Fiscal Year vs Financial Year

|

The terms Fiscal Year and Financial Year are synonymous, i.e. meaning the same thing. They are a period that governments use for accounting and budget purposes. However, they are also the duration on which tax... |

PAN Card vs AADHAR Card

|

PAN stands for Permanent Account Number. It is a number that is issued to any person who pays tax. Aadhar is an UID, i.e. a unique identification number. Its main purpose is to create a database of each... |

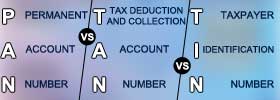

PAN vs TAN vs TIN

|

A PAN number is a number for anyone who pays income taxes or has financial transactions. TAN is required for any organization that deducts or collects tax at source. A TIN number is required by any dealer or... |

Sales Tax vs Value Added Tax (VAT)

|

Both Sales Tax and VAT are consumer taxes, which means that they have to be paid whenever one purchases a product that is meant to be consumed or used. However, sales tax is a type of direct tax, while VAT is... |