Difference between HMO and PPO

Key Difference: HMO has a rigid plan that includes electing a primary care physician who will take care of the medical needs of the insured. PPO has a more flexible plan that allows the patients to visit doctors that are not on their network for a discounted amount.

In countries where medical bill expenses are through the roof, it is best for many people to opt for medical insurance. This medical insurance allows people to consult doctors during sickness and not have to pay the full cost of the high medical bills. Because of the high cost of medical care in these countries, many employers have become obliged to offer medical insurance to its employees. There are many different types of insurance plans that are available and each one is more complicated than the other. Health maintenance organization (HMO) and Preferred provider organization (PPO) are two popular plans that are available under Medicare in the United States.

In countries where medical bill expenses are through the roof, it is best for many people to opt for medical insurance. This medical insurance allows people to consult doctors during sickness and not have to pay the full cost of the high medical bills. Because of the high cost of medical care in these countries, many employers have become obliged to offer medical insurance to its employees. There are many different types of insurance plans that are available and each one is more complicated than the other. Health maintenance organization (HMO) and Preferred provider organization (PPO) are two popular plans that are available under Medicare in the United States.

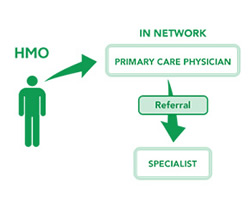

Health maintenance organization (HMO) is a health insurance plan that is offered by insurance companies in the United States. The HMO plan has a rigid structure in which the patient under the plan must elect a Primary care physician (PCP) that will be responsible for mapping and charting the patient’s whole medical care. Incase, the patient wishes to see a specialist, they would require a referral from their PCP. HMO is considered to be more restrictive when it comes to medical care as the patient can only pick from a select list of medical providers that are a part of the organization’s network and are contracted with them.

HMO is quite cheap and requires a monthly co-payment and there are no annual deductibles or claim forms. However, if the patient wishes to refer to a specific physician or specialist, no benefits would be provided by the insurance company. The patient would be responsible for the full payment of the doctor or the service provided. The doctors that are contracted on the HMO are paid on an annual pre-paid basis, where would receive the money whether or not they treat the patient. Because of this, doctors contracted on the HMO plan have been criticized for not providing proper medical care to their patients.

Preferred provider organization (PPO) is a health insurance plan that is an alternative to HMO offered by insurance companies in the United States. The PPO plan has a more flexible structure in which the patient under the plan can refer to any doctor in any vicinity that they wish that are under the network. The patient has the option to choose and visit any doctors and specialists as well as change their doctors if they are not happy. Patients under the PPO plan can also visit doctors that are not part of the network and would only have to pay for a part of their visit. The rest would be covered by the organization.

Preferred provider organization (PPO) is a health insurance plan that is an alternative to HMO offered by insurance companies in the United States. The PPO plan has a more flexible structure in which the patient under the plan can refer to any doctor in any vicinity that they wish that are under the network. The patient has the option to choose and visit any doctors and specialists as well as change their doctors if they are not happy. Patients under the PPO plan can also visit doctors that are not part of the network and would only have to pay for a part of their visit. The rest would be covered by the organization.

PPO are slightly bit expensive, but provides more flexibility about choosing medical practitioners. If the person chooses to visit a doctor that is not contracted under the organization’s network, the person would initially have to pay the whole amount, but they can later fill a claim form and ask for a percentage of reimbursement on the bill from the insurance company. The doctors contracted under the PPO plan are offered money on a pay-per-visit basis, which means that as many times the patient visits the doctor, the doctor can claim money from the organization. This plan has received criticism with many doctors asking patients to come in for unnecessary tests in order to claim more money from the companies.

There are quite a few differences between the HMO and PPO plans. While, HMO restricts the patient to only the doctors that they have on their network, PPO allows patients to avail doctors that are not on their network. HMO requires the patient to pay any expenses that are not covered under their plan, such as visits to doctors that are not on their network, specialists, medications, etc. PPOs offers a percentage of money in reimbursement, if the insured avails services not covered under the plan. HMOs are cheaper, while PPOs are comparatively expensive.

|

|

HMO |

PPO |

|

Stands for |

Health maintenance organization |

Preferred provider organization |

|

Definition |

An HMO creates and maintains a network of patients and doctors. HMO arranges managed care on a prepaid basis. |

A PPO creates a network of patients and doctors. PPO allows the patient to visit any doctor or specialist under the network for free, while visiting doctors out of the network will be partially paid by the company. |

|

How it runs |

Under the HMO plan, the patient will have to pick a Personal Care Physician that will be in charge of taking care of all medical needs of the patient. He/she will issue referrals for the patient incase specialists or special tests are required to be run. |

Under the PPO network, the patient can visit any physician or doctor that is under the plan for no cost. The patient also has the freedom to visit doctors that are not under the network and would only have to bear a part of a cost, the rest will be covered by the plan. |

|

Network |

A rigid network of doctors, patients, specialists and test centers are maintained. |

A network for doctors, specialists and test centers are created, but patients are free to visit other not on the network. |

|

Primary Care Physician (PCP) |

HMO requires a primary care physician that would take care of all medical care needs for the patient. |

PPO does not require a primary care physician. The patient has the freedom to choose any doctor on or off the network. |

|

Specialist |

The patient would require a referral from their PCP to visit a specialist that is on the network. |

The patient does not require a referral and can visit any doctor/specialist they want. |

|

Insurance claims |

The providers and not the patients will have to file a claim with the insurance company to get reimbursed. |

If the patient visits a provider from the network, then no. However, if the patient visits a doctor outside of the network, they would have to pay the full bill and then file a claim with the company to get partial reimbursement. |

|

Payment (in-service network) |

The patient would only have to pay co-payments and certain procedures or prescriptions that are no covered under the plan. |

The patient would only be responsible for co-payments or annual deductible for services. |

|

Payment (services out of network) |

The patient would be fully responsible for the paying doctors that are not under the network. |

The patient would only be partially responsible for paying the doctor or service not under the network. |

|

Prescriptions |

In most cases, prescription drugs are covered in HMO Plans. However, it certain plans may not include the prescriptions or certain type of prescriptions. |

In most cases, prescriptions are covered under the PPO plan. Again the coverage differs depending on the plan opted by the patient. |

|

Reimbursements |

Reimbursements are not available for patients under the plan. |

Reimbursements are available for patients that see out of network services. |

|

Medical problems covered |

Mostly Basic Medical care and Preventive care such as office visits, immunizations, well-baby checkups, and physicals. |

Mostly Basic Medical care and Preventive care such as office visits, immunizations, well-baby checkups, physicals, and specialist services. |

|

Emergency treatment |

HMO’s are not well suited for this since they have a defined procedure for emergency treatment outside its coverage area. |

Emergency treatments are also covered. |

|

Flexibility |

More rigid and restrictive with plans and doctors. |

More flexible with plans and medical care. |

|

Cost |

Cheaper |

Slightly more expensive |

|

Doctor/Medical Practitioner Payment plan |

Doctors/Medical Practitioners are paid on an annual basis whether the patient avails the service or no. |

Doctors/Medical Practitioners are paid on a pay per visit basis. So, patients have to visit the doctor. |

|

Clientele |

Large and small corporations |

Large retail clientele |

|

Disadvantages |

Doctors under this plan may become careless with their patients as they get paid either way. |

Doctors under this plan may require the patient to make multiple visits to run tests to get more money from the insurance company. |

Image Courtesy: ibx.com

Add new comment