Difference between Mutual Fund and SIP

Key Difference: A mutual fund isn’t exactly a type of security, but rather a scheme that allows the purchase of securities. An SIP or a Systematic Investment Plan is a mode of investing money in a mutual fund. It allows the investor to pay in installments, rather than a lumpsum payment in the beginning of the investment.

Mutual funds and SIP (Systematic Investment Planning) are both ways of investing in the share market. SIP is actually a type of mutual fund, rather a way of investing in a mutual fund. The main difference between the two is how money is put into the investment.

Mutual funds and SIP (Systematic Investment Planning) are both ways of investing in the share market. SIP is actually a type of mutual fund, rather a way of investing in a mutual fund. The main difference between the two is how money is put into the investment.

A mutual fund isn’t exactly a type of security, but rather a scheme that allows the purchase of securities. The term mutual fund has no legal definition and is applied to collective investment vehicles that are regulated and sold to the general public. This scheme is professionally managed that pools money from multiple investors and places the money in multiple investments. These companies are run by people with the know-how of the financial markets. They take the money and invest it in various shares across many companies, reducing the risk of losing a whole lot of money.

If a person invests in a mutual fund, what the scheme will do is take 1,000 dollars from 10 people, which would result in 10,000 dollars and put split it equally in shares of 10 companies. In case, one of the company’s share prices drops, it wouldn’t result in one person losing all of their money but rather 10 people losing a small amount of their money. This is a far safer option, then purchasing shares individually. It also makes the share market open for the general public that may not have any idea about investments or how the share markets work.

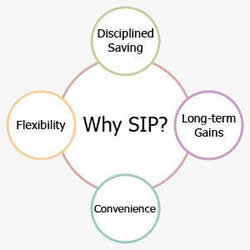

An SIP or a Systematic Investment Plan is a mode of investing money in a mutual fund. It allows the investor to pay in installments, rather than a lumpsum payment in the beginning of the investment. A SIP requires the investor to invest a pre-determined amount at a regular interval (monthly, quarterly, yearly, etc.). The scheme takes the details from the investor and automatically deducts the money on a determined date from the account. That money is then invested in a specific mutual fund scheme.

The money is then used to purchase a certain number of units based on the ongoing market rate. As more money is added, more units are purchased on different dates at different market rates, resulting in the investor benefitting from Rupee-Cost Averaging and the Power of Compounding. The benefit of an SIP is that the investor can stop the monthly investments at any time. They can also stop future payments, without disturbing the already invested money. The investor can also pull out part or all of the money, without having to pay any extra fees.

Comparison between Mutual Fund and SIP:

|

|

Mutual Fund |

SIP |

|

Definition |

Money from multiple investors is consolidated and invested into multiple shares |

Money previously determined is split into a convenient monthly or yearly plan that is invested into a mutual fund |

|

Types of investment |

Shares |

Shares |

|

Risky |

Risk is minimal |

Risk is minimal |

|

Advantages |

Risk is less as more people invest, more less the percentage of investment by one person becomes Losses are minimal Short term investment |

Investment is less, so loss is less Monthly payments compared to lumpsum money Easy removal from investment |

|

Disadvantages |

If the investor makes a mistake, a lot of people lose money |

Not always will a person get a good market rate Long term investment |

Image Courtesy: beginnersinvest.about.com, timesofindia.indiatimes.com

Add new comment