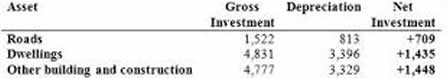

Difference between Net Investment and Gross Investment

Key Difference: Gross investment refers to the total expenditure on buying capital goods over a specific period of time without considering depreciation. On the other hand, Net investment considers depreciations and is calculated by subtracting depreciation from gross investment.

Investment refers to the amount invested in purchasing financial assets. Investment is done in order to obtain a good target return over a specified period of term. The target returns may be in any of the forms like an increase in the value of assets or securities. It may also refer to a regular income obtained from securities or assets. There are different types of investments like autonomous, induces, financial, real, planned, unplanned, gross and net.

Investment refers to the amount invested in purchasing financial assets. Investment is done in order to obtain a good target return over a specified period of term. The target returns may be in any of the forms like an increase in the value of assets or securities. It may also refer to a regular income obtained from securities or assets. There are different types of investments like autonomous, induces, financial, real, planned, unplanned, gross and net.

Gross investment refers to the amount invested in purchase or construction of new capital goods. Net investment is also related to gross investment. It is basically gross investment minus the depreciation on existing capital. This depreciation is related to some investment which needs to be made in order to replace obsoleted or worn out assets like plants and machineries.

Or we can say that, Net investment = gross investment – depreciation

If gross investment is greater than depreciation over any period of time then it directly refers that the net investment is positive which further implies that the capital stock has increased.

Similarly, if gross investment is less that depreciation, then in that case the net investment tends to be negative and the capital stock declines.

To understand the difference, one one can consider this example, a factory starts the year with 20 machines. It buys 5 machines. 10 machines are worn out. Now, the gross investment refers to the purchase of new machines which is 5, whereas at the end of the year the total number of working machines = 20+5-4 = 21. This leads to actual gain of 21-20 = 1 machine, which reflects the net investment.

Thus, gross investment is the total amount spent on goods in order to produce other goods and services, whereas net investment is the increase in productive stock.

Comparison between Net Investment and Gross Investment:

|

|

Net Investment |

Gross Investment |

|

Definition |

It is estimated by subtracting capital depreciation from gross investment. |

The total amount spent on purchasing new assets |

|

Formula |

Net investment = gross investment – depreciation |

Gross Investment = a total purchase or construction of new capital goods |

|

Importance |

It helps in providing a sense that how much money is being spent on capital items taking into considerations the losses like maintenance, wear and tear, etc. Thus, it helps in expanding operations and improving efficiency. On neglecting the depreciations one may have to face ad-hoc situations related to obsolete or worn out devices. |

Helps in determining the total expenditure on capital goods |

|

Includes |

The changes to the capital stock |

All new investment –

|

|

Indicator |

Generally, considered to be a better indicator than gross investment |

Not considered to be a better indicator in comparison to net investment |

Image Courtesy: economic-incentives.blogspot.com

Add new comment