Difference between Traveller’s Check and Cashier's Check

Key Difference: Traveler’s check is a pre-printed note that has a number printed on it. This paper can be used to replace hard currency and is often used when traveling abroad. A cashier’s check is check in which the money is guaranteed by the bank. The issuer would provide the bank with a check of how much money it wants to pay someone plus the fee of issuing the cashier’s check.

Traveller’s/Traveler’s check and Cashier’s check are two of the many methods of payment. They both serve different purposes are used in different scenarios. Although, the uses can be confusing the name itself should help in trying to set them apart.

Traveller’s/Traveler’s check and Cashier’s check are two of the many methods of payment. They both serve different purposes are used in different scenarios. Although, the uses can be confusing the name itself should help in trying to set them apart.

Traveler’s check is a pre-printed note that has a number printed on it. This paper can be used to replace hard currency and is often used when traveling abroad. This note has all the information that is required. These notes are often issued in the currency to which the issuer is traveling to for example, if the issuer is going to the UK and he lives in the US, he will issue the currency in Pounds.

The checks are a safe way to carry around cash when traveling as it requires two signature in order for it to be cashed – one when the checks are issued and the second when the checks are being cashed. They can also be replaced for free in case they are lost or stolen. However, like everything in life they require a little hard work. The checks have serial numbers, the issuer must note these serial numbers when he gets them and mark the ones that he spend. If he doesn’t have the serial number, he cannot ask for replacements.

Traveler’s checks were a popular from of foreign currency, but with the new age of computers and plastic money, they are slowly dying out. This is mostly because of how expensive it is. The issuing company charges are fee to issue the checks. Also, it gets a very low conversation rate, which means a person gets very less per currency they convert. There are also some currencies that you might not be able to get the checks is, so most people get the checks in well-known currencies such as dollars, pounds or euros. Many places have even stopped taking the traveler checks, so now credit cards, debit cards and travel cards have taken its place.

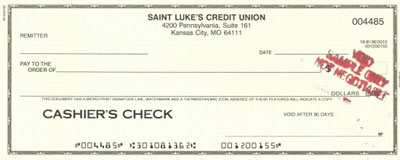

A cashier’s check is check in which the money is guaranteed by the bank. The issuer would provide the bank with a check of how much money it wants to pay someone (for ex: an institution, another bank, etc), plus the fee of issuing the cashier’s check. The bank will insure that the issuer has that much money in his account and withdraw that amount and add it to their account. The cashier’s check would have the name of the person to whom the money is being paid and the money would be then paid from the bank’s account.

A cashier’s check is check in which the money is guaranteed by the bank. The issuer would provide the bank with a check of how much money it wants to pay someone (for ex: an institution, another bank, etc), plus the fee of issuing the cashier’s check. The bank will insure that the issuer has that much money in his account and withdraw that amount and add it to their account. The cashier’s check would have the name of the person to whom the money is being paid and the money would be then paid from the bank’s account.

This is a popular form of payment for large amounts, such as purchasing a house or paying tuition (in some cases). Many people prefer cashier’s checks as it ensures that the money is there and the check will not bounce. However, there are some set banks when compared to personal checks.

While personal checks can be stopped from being encashed if the check number is given to the bank, in the case of a cashier’s check there is no certainty. The person can let the bank know so they can flag the check in case it comes in, but it will require a minimum of 90 days to get the money refunded. The person would have to file a declaration of loss, following which the money will refunded after a 90 day period of approvals. Some banks may also issue a replacement check for a fee but if the amount is big, banks may not want to pay from their own pockets until the money is refunded. In that 90 day period, if the check is cashed, then the money may be given to the thief.

Traveler’s checks and cashier’s check may sound similar because of the checks but they both serve completely different purposes. Traveler’s checks are more for when a person is traveling abroad, while cashier’s checks are for paying large amounts.

Comparison between Travellers Check and Cashier's Check:

|

|

Travellers Check |

Cashier's Check |

|

Place of use |

Abroad |

Local |

|

Payee |

Do not require a name on the traveler check |

Requires a name of the person to whom that check is going to be paid |

|

Safety |

Requires 2 signatures |

Requires the name of the person being paid to and only they can encash it. Also requires a signature of the issuer |

|

Best for |

Spending abroad |

Large amounts |

|

Reissue |

If lost or stolen, it can be re-issued free of cost |

If the check is lost or stolen, the bank may or may not reissue the check (it depends on the bank). The issuer would have to file for a declaration of loss and show a copy of the check in order to claim the money back. The money will be returned in 90 days. |

|

Fees |

A 1% to 4% charge is levied as commission by the business accepting it. The bank where the check is issued may also charge a small fee to issue the checks |

A small issuance fee is charged, but no other fees |

|

Advantages |

|

|

|

Disadvantages |

|

|

Image Courtesy: geoskimcumen.37k.org, checkguarantee.com

Comments

submariner role...

Wed, 11/01/2017 - 18:46

Add new comment