Difference between Share and Mutual Fund

Key Difference: Shares are a type of equity investment or financing and are a unit of financing. A mutual fund isn’t exactly a type of security, but rather a scheme that allows the purchase of securities.

Shares and mutual funds are two types of investments that are available in the market. Shares and mutual funds are two different types of securities, which are basically any tradable financial asset of any kind.

Shares and mutual funds are two types of investments that are available in the market. Shares and mutual funds are two different types of securities, which are basically any tradable financial asset of any kind.

Shares are a type of equity investment or financing and are a unit of financing. These are securities issue by companies in order to raise capital. It’s a form of equity financing, which requires the company to sell ownership in the form of shares. So, if a company is looking to raise finances it will issue shares, which would divide its capital in the form of shares, these shares are then put on the stock market available for purchase. A shareholder basically buys a portion of the company, when he purchases the stock. The purchaser can attend the shareholder’s meeting, as well as vote on big decisions. The higher the number of stocks or shares, the more input the investor gets in how the business is run. The profit is usually the percentage of the required income. However, if the company is liquidated, the investors also suffer as the price of the shares would fall.

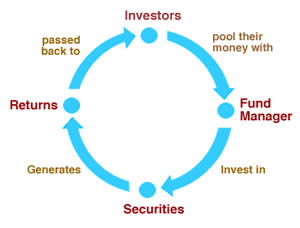

A mutual fund isn’t exactly a type of security, but rather a scheme that allows the purchase of securities. This scheme is professionally managed that pools money from multiple investors and places the money in multiple investments. The term mutual fund has no legal definition and is applied to collective investment vehicles that are regulated and sold to the general public. These companies are run by people with the know-how of the financial markets. They take the money and invest it in various shares across many companies, this reduces the risk of losing a whole lot of money. If a person invests in a mutual fund, what the scheme will do is take 1,000 dollars from 10 people, which would result in 10,000 dollars and put split it equally in shares of 10 companies. In case, one of the company’s share prices drops, it wouldn’t result in one person losing all of their money but rather 10 people losing a small amount of their money. This is a far safer option, then purchasing shares individually. It also makes the share market open for the general public that may not have any idea about investments or how the share markets work.

A mutual fund isn’t exactly a type of security, but rather a scheme that allows the purchase of securities. This scheme is professionally managed that pools money from multiple investors and places the money in multiple investments. The term mutual fund has no legal definition and is applied to collective investment vehicles that are regulated and sold to the general public. These companies are run by people with the know-how of the financial markets. They take the money and invest it in various shares across many companies, this reduces the risk of losing a whole lot of money. If a person invests in a mutual fund, what the scheme will do is take 1,000 dollars from 10 people, which would result in 10,000 dollars and put split it equally in shares of 10 companies. In case, one of the company’s share prices drops, it wouldn’t result in one person losing all of their money but rather 10 people losing a small amount of their money. This is a far safer option, then purchasing shares individually. It also makes the share market open for the general public that may not have any idea about investments or how the share markets work.

Comparison between Share and Mutual Fund:

|

|

Share |

Mutual Fund |

|

Ownership |

Provides ownership in the company |

Investor does not really own a stake. |

|

Identity |

Known as a shareholder |

Known as a shareholder |

|

Returns |

No certainty of returns. If company profits returns will be provided |

Returns are higher as risk is minimal |

|

Control |

Right to participate and vote on the company’s decisions |

No control or voting right provided |

|

Losses |

Will also shoulder the losses |

Will suffer minimized losses |

|

Interest |

Not fixed, if profits are higher so is the dividend |

Not fixed, if profits are higher so is the dividend |

Image Courtesy: canstar.com.au, toptradersindia.com

Add new comment