Difference between Swift Code and IBAN Code

Key Difference: SWIFT stands for Society for Worldwide Inter-bank Financial Telecommunication. It is used as a bank identifier in case of international transactions. SWIFT code is a code that is assigned to any institution that acts as the institution’s identity in the foreign market. IBAN stands for IBAN stands for International Bank Account Number. It is used as an identifier of an individual account for the international transactions.

IBAN and SWIFT both are usually used in context to financial system. SWIFT code and IBAN both are used for the international transactions. Thus, sometimes it can be difficult to find out the differences between them. However, they both are different to each other in many terms. Let us explain the differences in this article.

SWIFT code is a short for an even longer acronym known as SWIFT/BIC - Society for Worldwide Inter-bank Financial Telecommunication/ Bank Identifier Code. This code was established in 1973 in Brussels as an identifier code. This code is assigned to both financial and non-financial institutions. When assigned to a business, it may also be known as a BEI or Business Entity Identifier. The purpose of this code is to allow easy transference of money between banks, specifically from one country to another. In addition to money, the banks also communicate with each other using this code and it can sometimes be found on bank statements.

SWIFT can also supply software and other services to banks and other financial institutions. The SWIFT code acts as the identity of the bank when it sends or receives a transaction. The code lets the other institutions know three main things the name of the bank, where the head office is located. For example the SWIFT code for the primary office of Deutsche Bank would be DEUTDEFF. The code is made up of:

SWIFT can also supply software and other services to banks and other financial institutions. The SWIFT code acts as the identity of the bank when it sends or receives a transaction. The code lets the other institutions know three main things the name of the bank, where the head office is located. For example the SWIFT code for the primary office of Deutsche Bank would be DEUTDEFF. The code is made up of:

DEUT – for Deutsche Bank

DE – for Germany, the country where the headquarters are located

FF – for Frankfurt, the city where the headquarters are located

The code is usually made up of 8-11 characters and is commonly made up such as the example given above: the name of the company and the city and country of the headquarters. This SWIFT code easily helps the institutions recognize each other. A person that is sending or receiving money from one country to another is commonly asked for the SWIFT code of the bank from which it is sending/receiving the money.

IFSC is a unique code and the code is of immense importance in carrying out the transactions in the banking sector. It is printed in the check books or can be easily found online by searching the code of the bank branch.

IBAN number stands for International Bank Account Number. It is used to identify the bank accounts between the countries. This number was originally adopted by the European Committee for Banking Standards and later was adopted as an International Standard. It has been used by most of the European countries. Some other countries like in the Middle East and in the Caribbean are also using IBAN.

Committee for Banking Standards and later was adopted as an International Standard. It has been used by most of the European countries. Some other countries like in the Middle East and in the Caribbean are also using IBAN.

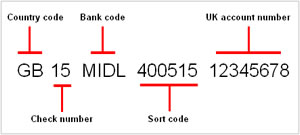

Let us understand the structure of IBAN. Firstly, it consists of up to 34 alphanumeric characters. The first two letters are the country codes that have been defined in ISO 3166-1, part of the ISO 3166 standard. It represents countries and special areas. Then, the two country codes are followed by the two digits; also known as check digits. These digits are used for detecting any errors on identification numbers. Finally, it contains the basic bank account number. For example, the format of IBAN for Czech Republic is

CZkk BBBB CCCC CCCC CCCC CCCC

CZ is the country code for Czech Republic

B denoted the bank code

C denotes the domestic account number.

The IBAN has two formats - electronic format (without blanks) and written representation (with groups of 4 characters separated by blanks)

Both of them are referred in context to international transfers between accounts. However, still they are different from each other. The format is also different as well as there are major differences between them. In SWIFT, messages are securely and reliably exchanged between financial institutions world wide whereas IBAN can only be used primarily between European banks. SWIFT is used to identify the branch of the bank, whereas IBAN is the account number. IBAN is primarily used to electronically transfer money from one account to the other, whereas SWIFT is used both for financial and non financial purposes.

Image Courtesy: bankkhojo.com, business.hsbc.co.uk

Add new comment