Difference between IFSC Code and BSR Code

Key Difference: In context to Indian banking, both refer to unique codes. IFSC stands for Indian Financial System Code. IFSC code is made up of eleven characters and used to identify the branch of bank. BSR stands for basic statistical returns. BSR code is a seven digit number that is used by the Income Tax department in order to identify a bank branch for submission of returns to the RBI.

IFSC and BSR both can be used in context to Indian financial system codes. IFSC and BSR both codes are used to represent the branch of a bank uniquely. Therefore, confusion may arise that if they share the basic definition then what is the difference between them. The difference is not only in the number of characters that are used to represent the code but apart from this, they both are used in different systems. Let us clear the differences in the following article.

IFSC stands for Indian Financial System Code. It consists of eleven characters and this code has been assigned by Reserve Bank of India for the identification of the bank branches. It uniquely identifies any bank branch in India. This code is of immense importance for carrying out the electronic payments in the country.

IFSC stands for Indian Financial System Code. It consists of eleven characters and this code has been assigned by Reserve Bank of India for the identification of the bank branches. It uniquely identifies any bank branch in India. This code is of immense importance for carrying out the electronic payments in the country.

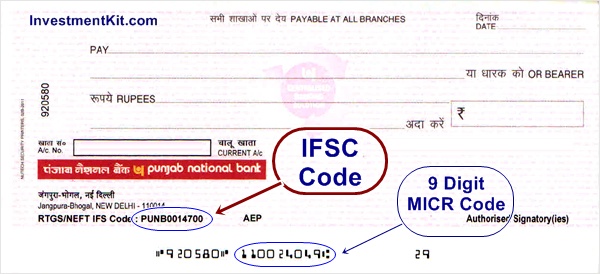

The components of this alpha numeric code are:-

1. First four characters denote the code of Bank.

2. The fifth character is a ‘0’ and this is left for future use.

3. Remaining six characters define the specific branch of the bank.

The payment methods like RTGS, CFMS and NEFT in India uses this code. All the banks have been adviced by Reserve Bank of India to print the IFSC code on the checks issued by the banks to their customers.

BSR stands for basic statistical returns. The BSR code consists of seven digits and is allotted to banks by Reserve Bank of India. While filling TDS/TCS (tax deducted at source/.jpg) tax collected at source) returns, BSR code is used in details related to challan and deductee. This code is unique for each bank branch but still it is quite different from the branch code that is used in bank drafts etc.

tax collected at source) returns, BSR code is used in details related to challan and deductee. This code is unique for each bank branch but still it is quite different from the branch code that is used in bank drafts etc.

This code is used to form the unique challan identification number (CIN). The CIN also consists of date of deposit and challan serial number of five digits. This is important in context to Income Tax department as the challan details comprising of CIN are also uploaded. This helps the department to maintain the records related to online payment of tax through banks. In addition to this, the department also receives information of the payment of tax through the banks.

Both are used to represent the branches of banks through unique codes. However, IFSC code is mainly used in context to checks whereas BSR is used by the Income Tax department in order to identify a bank branch for submission of returns to the RBI.

Image Courtesy: bankkhojo.com, lawcrux.org

Comments

Cee Bee

Wed, 11/08/2017 - 13:49

Add new comment