Difference between Debit and ATM Card

Key difference: ATM cards can be used at an ATM machine to withdraw money by using a PIN. Debit cards can be used to at an ATM machine to withdraw money by using a PIN, as well as to make purchases at stores, on the phone and the internet.

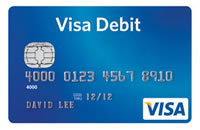

Both debit and ATM cards are small rectangular plastic cards issued by a financial institution, such as a bank or credit union. They are linked to the card holder’s bank account. Their main purpose is to allow the account holder to access the money in their account without actually traveling to the bank during official bank hours.

Both debit and ATM cards are small rectangular plastic cards issued by a financial institution, such as a bank or credit union. They are linked to the card holder’s bank account. Their main purpose is to allow the account holder to access the money in their account without actually traveling to the bank during official bank hours.

Both debit and ATM cards can be used at an Automated Teller Machine (ATM) machine to withdraw money by using a Personal Identification Number (PIN) number, which is unique to each card holder. However, debit cards usually have a much larger scope, i.e. they can be used at more locations than a traditional ATM card, which is usually limited to the bank’s ATMs and some other bank’s ATMs, which have a tie-up with the account holder’s bank.

Furthermore, debit cards can be used to make purchases at most stores, and even over the phone and internet, as these cards are usually processed over Visa or MasterCard networks, which have a much larger national and even international scope. On the other hand, ATM cards can only be used at stores which accept the ATM network provider. These stores are rare and usually accept ATM cards of banks located regionally, whereas, one can use a debit card internationally.

Furthermore, debit cards can be used to make purchases at most stores, and even over the phone and internet, as these cards are usually processed over Visa or MasterCard networks, which have a much larger national and even international scope. On the other hand, ATM cards can only be used at stores which accept the ATM network provider. These stores are rare and usually accept ATM cards of banks located regionally, whereas, one can use a debit card internationally.

Essentially, an ATM card has a very limited usage and is effectively good to use ATM machines. However, a debit card is in fact an ATM card with additional uses. This is why many banks now offer debit cards instead of ATM cards.

A detailed comparison between Debit and ATM cards:

|

|

Debit Card |

ATM Card |

|

Appearance |

Rectangular plastic card with name of institution. Feature the logo of a major payment processing network, such as Visa, or MasterCard.

|

Rectangular plastic card with name of institution. May or may not feature the logo of an ATM network provider. |

|

Account Number |

16 digit account number, different from the bank account number. |

Features the bank account number, which may be any number of digits. |

|

Signature panel |

The card holder must sign a signature panel on the back of card. |

May or many not have a signature panel. |

|

Used at |

Any ATM machine that features the logo of the processing network that handles the card. To make purchases at Point Of Sale (POS) machines in stores, by either entering their PIN or swiping the card and signing for the transaction. Can be used to make purchases online or on the phone. |

ATM card holders can only access funds at ATM machines that feature the logo of the ATM network operator. Some ATM cards do not carry the logo of a network operator, in which case card holders can only access funds at ATMs operated by their own bank. May or may not be used to make purchases. |

|

Scope |

ATM machines across the world carry the logos of Visa and MasterCard. |

Usually regionally, nationally at times. |

|

Personal Identification Number (PIN) |

Card holders are issued a PIN number to use in care of withdrawals. PIN may or may not be used for purchases. |

Card holders are issued a PIN number to use in care of withdrawals or purchases. |

Image Courtesy: indiamart.com, debitcardsau.blogspot.in

Comments

Abhinav Taprial

Sat, 10/21/2017 - 18:53

Nicely explained....

Reyansh Rahul

Fri, 06/19/2015 - 14:40

ATM means

Arshid ahmad

Sat, 11/22/2014 - 19:33

Automated Teller Machine or in short ATM

Nikita

Mon, 11/24/2014 - 14:36

Add new comment